The initial public offering (IPO) market has long been considered a potential source of passive income for investors. However, like any investment, it has its pros and cons. This article will delve deep into the world of IPOs, exploring the benefits and drawbacks of using them as a source of passive income.

The Concept of IPO and Passive Income

An initial public offering (IPO) is the process by which a privately held company goes public by selling its shares to the public for the first time. This process allows companies to raise capital from public investors. On the other hand, passive income is income that requires little to no effort to earn and maintain. It typically comes from rental property, limited partnership, or other enterprises in which the investor is not actively involved.

Pros of IPOs for Passive Income

The potential for high returns is one of the most significant advantages of investing in IPOs. When a company goes public, the initial offering can often lead to substantial profits for investors who get in early. Here are some potential benefits:

- High Returns: IPOs can potentially offer high returns, especially for early investors.

- Diversification: Investing in IPOs can provide diversification to your investment portfolio.

- Growth Opportunities: IPOs can offer investors exposure to new, fast-growing sectors and industries.

Cons of IPOs for Passive Income

While the potential for high returns can make IPOs an attractive investment, they also come with considerable risk. Here are some of the cons associated with investing in IPOs:

- High Risk: IPOs can be risky, as the lack of historical data can make it difficult to predict a company’s future performance.

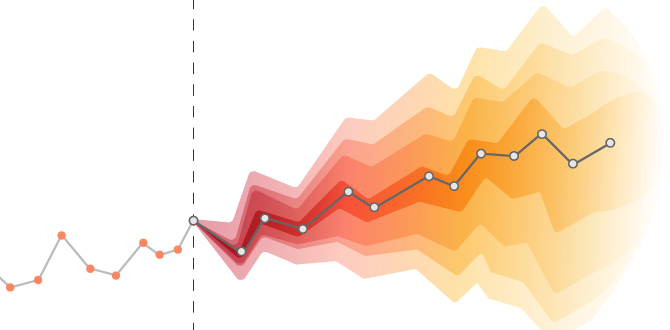

- Volatility: Stocks of newly listed companies can be highly volatile, which can lead to potential losses.

- Uncertain Dividends: Newly public companies may not pay dividends initially, which could affect your passive income stream.

Practical Tips for Investing in IPOs

If you decide to invest in IPOs, here are some practical tips to help you navigate the process:

- Research: Conduct thorough research on the company, its business model, and its financial health before investing.

- Invest Wisely: Don’t invest more than you can afford to lose. Diversify your investments to minimize risk.

- Monitor Your Investments: Keep an eye on your investments, and be ready to act if the market conditions change.

FAQ

What is an IPO?

An IPO, or Initial Public Offering, is the process by which a privately held company goes public by selling its shares to the public for the first time.

What is passive income?

Passive income is income that requires little to no effort to earn and maintain. It typically comes from rental property, limited partnership, or other enterprises in which the investor is not actively involved.

Are IPOs a good source of passive income?

While IPOs can potentially offer high returns, they also come with considerable risk. Therefore, they may not be the best source of passive income for everyone.

Remember that investing in IPOs, like any investment, involves risk. It’s essential to do your due diligence and consult with a financial advisor before making any investment decisions. The potential for high returns can be tempting, but it’s crucial to understand the risks and be prepared for the possibility of losses.

Leave a Reply