What This Page Covers

This page provides an informational overview of token investment for retirement, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding token investment for retirement

Token investment for retirement involves allocating funds into digital tokens, often known as cryptocurrencies or digital assets, with the intention of using them as part of a retirement portfolio. With the rise of blockchain technology, digital tokens have emerged as an innovative financial instrument, attracting significant interest from individual investors and financial institutions alike.

People search for information on token investment for retirement for several reasons. First, there’s a growing interest in diversifying retirement savings beyond traditional assets like stocks and bonds. Second, some investors are drawn to the potential high returns associated with cryptocurrencies, despite their volatile nature. Lastly, the increasing acceptance and regulatory advancements surrounding digital assets have legitimized their use in retirement planning discussions.

In financial and market-related contexts, token investments are often discussed in terms of their risk-reward profile, regulatory implications, and technological underpinnings. Analysts frequently emphasize the importance of understanding both the potential and the pitfalls of integrating tokens into long-term investment strategies.

Key Factors to Consider

When considering token investment for retirement, several key factors emerge as important:

1. **Volatility:** Cryptocurrencies are known for their price volatility, which can lead to substantial gains or losses. This volatility requires investors to have a high risk tolerance.

2. **Regulatory Environment:** The regulatory landscape for digital tokens is evolving. Understanding the legal status and compliance requirements in different jurisdictions is crucial for investors.

3. **Security Risks:** The digital nature of tokens makes them susceptible to cybersecurity threats, such as hacking and fraud. Implementing strong security measures is essential to protect investments.

4. **Diversification:** As with any investment, diversification is key. Combining token investments with traditional assets can help in managing overall portfolio risk.

5. **Tax Implications:** Cryptocurrencies may have unique tax treatment. Investors should be aware of potential tax liabilities and reporting requirements.

6. **Market Adoption:** The adoption rate of cryptocurrencies in mainstream financial systems can influence their long-term viability as retirement investments.

Common Scenarios and Examples

To better understand token investment for retirement, consider the following scenarios:

– **Scenario 1: Diversified Portfolio**

An investor includes a small percentage of digital tokens in their retirement portfolio along with stocks, bonds, and real estate. This strategy aims to capture potential high returns from tokens while maintaining overall portfolio stability.

– **Scenario 2: Crypto-Only Portfolio**

A risk-tolerant investor decides to allocate a significant portion of their retirement savings exclusively into cryptocurrencies. This approach might be suitable for individuals with strong conviction in the future of blockchain technology and digital currencies.

– **Scenario 3: Regulated Investment Products**

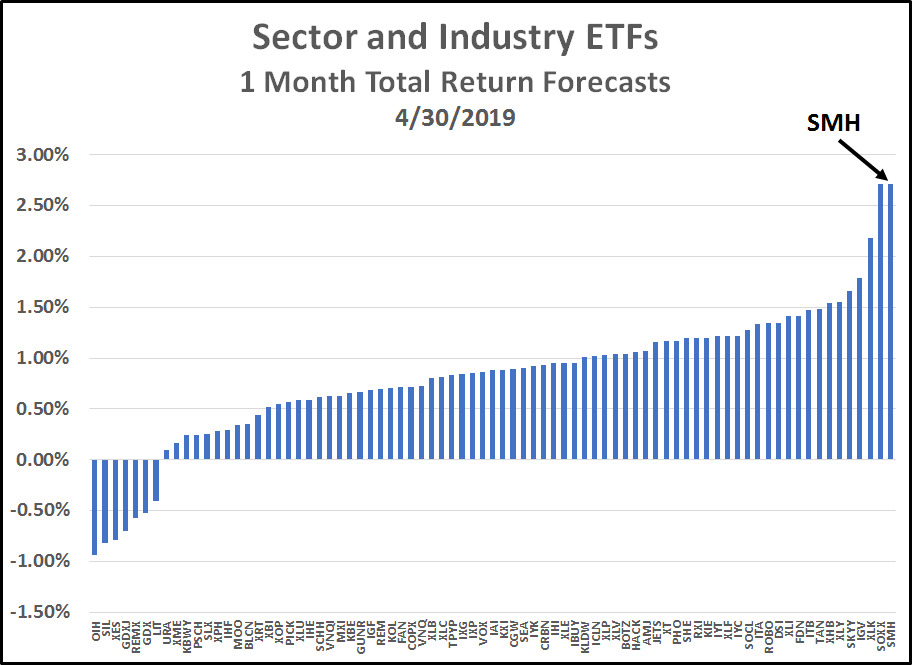

As the market matures, investors may choose to invest in cryptocurrency funds or ETFs that are regulated and professionally managed, providing exposure to digital assets while reducing individual risk.

These scenarios highlight the varied ways in which tokens can fit into retirement planning, emphasizing the importance of aligning investment strategies with personal financial goals and risk tolerance.

Practical Takeaways for Readers

- Understand the volatility and risk associated with token investments and determine if they align with your retirement goals and risk tolerance.

- Avoid the misconception that high returns are guaranteed with cryptocurrencies; market conditions can change rapidly.

- Review independent sources like regulatory filings, financial reports, and reputable publications to gather insights and make informed decisions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is token investment for retirement?

Token investment for retirement refers to the allocation of funds into digital tokens, such as cryptocurrencies, as part of a retirement savings strategy.

Why is token investment for retirement widely discussed?

Interest in token investment for retirement is driven by the desire to diversify portfolios, potential for high returns, and the growing legitimacy of digital assets.

Is token investment for retirement suitable for everyone to consider?

Token investment may not be suitable for everyone, as it depends on individual financial goals, risk tolerance, and understanding of the digital currency market.

Where can readers learn more about token investment for retirement?

Readers can explore official filings, company reports, and reputable financial publications to gain a deeper understanding of token investment for retirement.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply