What This Page Covers

This page provides an informational overview of financial news prediction breaking, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding financial news prediction breaking

Financial news prediction breaking refers to the analysis and anticipation of financial market movements based on newly released news. These predictions are typically derived from a variety of data points such as economic reports, corporate announcements, and geopolitical events. People search for financial news prediction breaking to gain an edge in market timing, enhance their investment strategies, or simply to stay informed about potential market trends. This topic is commonly discussed among traders, investors, and financial analysts who aim to interpret the influence of news on market behavior.

Key Factors to Consider

Several key factors are associated with financial news prediction breaking:

- Timing of News Release: The timing of news, whether during or after trading hours, can significantly affect market reactions.

- Market Sentiment: Understanding the prevailing market sentiment helps in assessing how news might be interpreted by the majority.

- Source Credibility: The credibility of the news source determines how seriously the news is taken by the market.

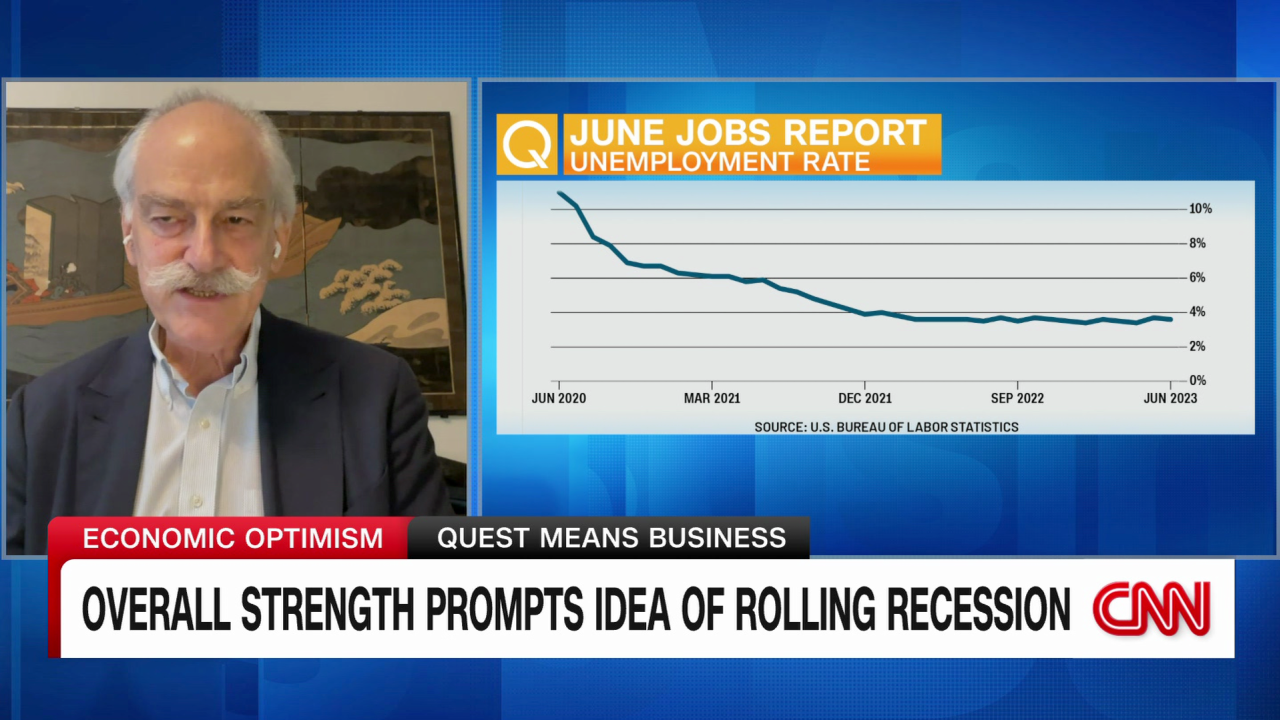

- Economic Indicators: Data such as GDP, unemployment rates, and inflation figures are critical in shaping market predictions.

- Historical Patterns: Analyzing past market responses to similar news events can provide insights into possible future reactions.

Common Scenarios and Examples

One common scenario involves a central bank’s announcement regarding interest rate changes. Such news can lead to immediate market volatility as investors adjust their portfolios in anticipation of the economic impact. Another example is a major corporation releasing quarterly earnings reports that exceed or fall below expectations, resulting in stock price fluctuations. Geopolitical events, such as trade agreements or international conflicts, also serve as pertinent examples where news prediction plays a role in market dynamics.

Practical Takeaways for Readers

- Readers should be aware that while predicting market movements is possible, it is inherently uncertain and involves risks.

- A common misunderstanding is that news prediction guarantees returns, whereas it should be considered as one of many tools in decision-making.

- Readers may want to review information from credible sources like official filings, company reports, and reputable financial publications to form a well-rounded view.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is financial news prediction breaking?

Financial news prediction breaking involves analyzing and anticipating market movements based on newly released financial news.

Why is financial news prediction breaking widely discussed?

It is widely discussed because it offers potential insights into market trends and helps investors and traders make informed decisions.

Is financial news prediction breaking suitable for everyone to consider?

While it can be useful, its suitability depends on individual circumstances, goals, and risk tolerance.

Where can readers learn more about financial news prediction breaking?

Readers can learn more from official filings, company reports, and reputable financial publications.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply