What This Page Covers

This page provides an informational overview of inflation prediction, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Inflation Prediction

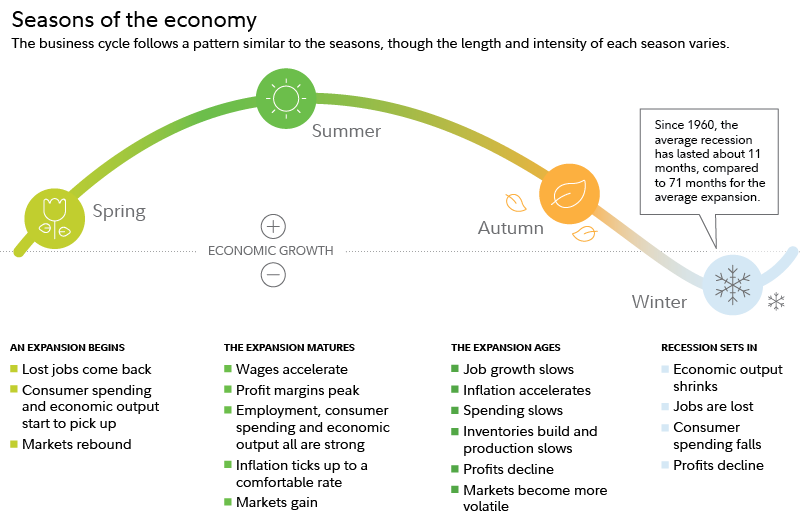

Inflation prediction involves forecasting the rate at which prices for goods and services will rise, impacting the purchasing power of currency over time. It is a crucial component of economic analysis as inflation affects interest rates, wages, and overall economic growth. People often search for inflation predictions to make informed decisions regarding investments, savings, and consumption. In financial and market-related contexts, understanding inflation trends helps businesses and policymakers design strategies to mitigate adverse effects.

Key Factors to Consider

Several key factors influence inflation predictions:

Monetary Policy: Central banks, such as the Federal Reserve, use tools like interest rates and open market operations to control inflation. Changes in these policies can signal expected inflation trends.

Supply and Demand Dynamics: When demand outpaces supply, prices tend to rise, contributing to inflation. Conversely, an increase in supply without corresponding demand can lead to price stabilization or deflation.

Wage Growth: Rising wages can lead to increased consumer spending, potentially driving up prices if supply does not keep pace.

Commodity Prices: Fluctuations in the prices of commodities like oil and food can directly affect inflation rates, given their essential roles in the economy.

Exchange Rates: A weaker national currency makes imports more expensive, contributing to inflationary pressures.

Common Scenarios and Examples

To illustrate how inflation prediction is analyzed, consider a scenario where a central bank hints at raising interest rates to curb rising inflation. Analysts would examine historical data, current economic indicators, and policy statements to assess the potential impacts on inflation and economic growth.

Another example involves supply chain disruptions, such as those seen during global crises, which can lead to shortages and drive up prices. Analysts study these patterns, factoring in the length of disruptions and recovery timelines, to predict inflation trends.

Practical Takeaways for Readers

- Stay informed about central bank announcements and economic reports, as these provide insights into potential inflationary trends.

- Avoid assuming that inflation predictions are guarantees; they are forecasts based on available data and are subject to change.

- Consult multiple sources, such as government reports, financial news, and economic analyses, to form a well-rounded view of inflation predictions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is inflation prediction?

Inflation prediction is the process of forecasting future inflation rates based on various economic indicators and models.

Why is inflation prediction widely discussed?

Inflation prediction is crucial because it influences economic policy, investment strategies, and personal financial planning.

Is inflation prediction suitable for everyone to consider?

While understanding inflation is beneficial, the relevance of specific predictions varies based on individual financial goals and circumstances.

Where can readers learn more about inflation prediction?

Readers can explore official filings, company reports, and reputable financial publications to gain deeper insights into inflation predictions.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply