Every person dreams of achieving financial freedom. It is a state where one is not burdened by financial constraints and can live the life they choose. Two major concepts often linked to financial freedom are financial independence and passive income. While they may seem similar, there are significant differences between the two. This article aims to explain these differences and provide insights on how to achieve both.

Defining Financial Independence

The term financial independence refers to a state where one has enough personal wealth to live without the need to work actively for basic necessities. It means your savings, investments, and other income sources are more than enough to cover your living expenses. It’s about maintaining your lifestyle without a regular paycheck. Financial independence gives you the freedom to pursue your passions, take risks, and spend quality time with your loved ones.

Defining Passive Income

On the other hand, passive income refers to the money you earn that requires little to no effort to maintain. It’s the earnings from rental properties, royalties, investments, or a side business that doesn’t require your active participation. Passive income can contribute significantly to achieving financial independence, as it provides a steady income stream without trading your time for money.

How Financial Independence Differs from Passive Income

While financial independence and passive income are related, they are not the same. Financial independence is about having enough wealth to cover your expenses for the rest of your life. Passive income, however, is a strategy to achieve financial independence. It’s one of the many ways to build wealth without putting in consistent active work.

Practical Tips on Achieving Financial Independence and Passive Income

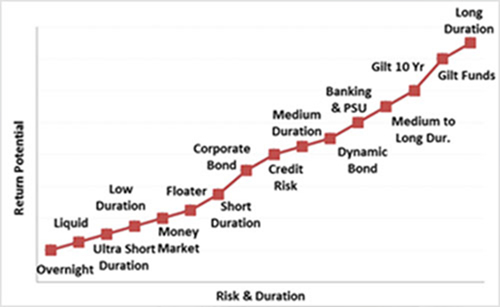

- Save and Invest: It’s crucial to save a portion of your income and invest it wisely. Investing in stocks, bonds, real estate, or starting a side business can generate passive income over time.

- Minimize Expenses: Keep your expenses low and live below your means. This can help you save more and invest more towards your financial independence.

- Financial Education: Learning about personal finance, investing, and money management can help you make informed decisions and avoid costly mistakes.

- Diversify Your Income: Don’t rely on a single source of income. Diversify and create multiple streams of income, including passive income.

FAQs About Financial Independence and Passive Income

Is passive income necessary for financial independence?

While it’s not absolutely necessary, having passive income can significantly speed up your journey to financial independence. It provides a stable income source without requiring your active involvement.

Can I achieve financial independence without a high-paying job?

Yes, financial independence is not about how much you earn but how much you save and invest. Even with a moderate income, by managing your finances wisely, you can achieve financial independence.

The journey towards financial independence and generating passive income is a marathon, not a sprint. It requires patience, discipline, and financial knowledge. But the freedom and peace of mind it offers make it worth the effort.

Leave a Reply