With the increasing cost of living and the unpredictable nature of the economy, relying solely on a single source of income is no longer viable for many. This is where the concept of passive income comes into play, offering a financial safety net and an opportunity to grow wealth over time without requiring a constant time investment. This article aims to guide small investors in exploring potential pathways to generate passive income.

Understanding Passive Income

Passive income refers to the money you earn that doesn’t require you to do a lot of “active” work to continue making it. For small investors, it means an opportunity to grow their wealth gradually without the need for a significant initial investment or continuous effort. Examples of passive income include rental income, dividend income, interest income, royalties, and income from businesses in which the investor is not actively involved.

Why Passive Income is Essential for Small Investors

Passive income can serve as a financial safety net, especially during uncertain economic times. It allows small investors to diversify their income streams, making them less reliant on one source. Moreover, it provides an opportunity to accumulate wealth over time, paving the way to financial independence.

Passive Income Opportunities for Small Investors

There are numerous ways small investors can generate passive income. Here are a few options:

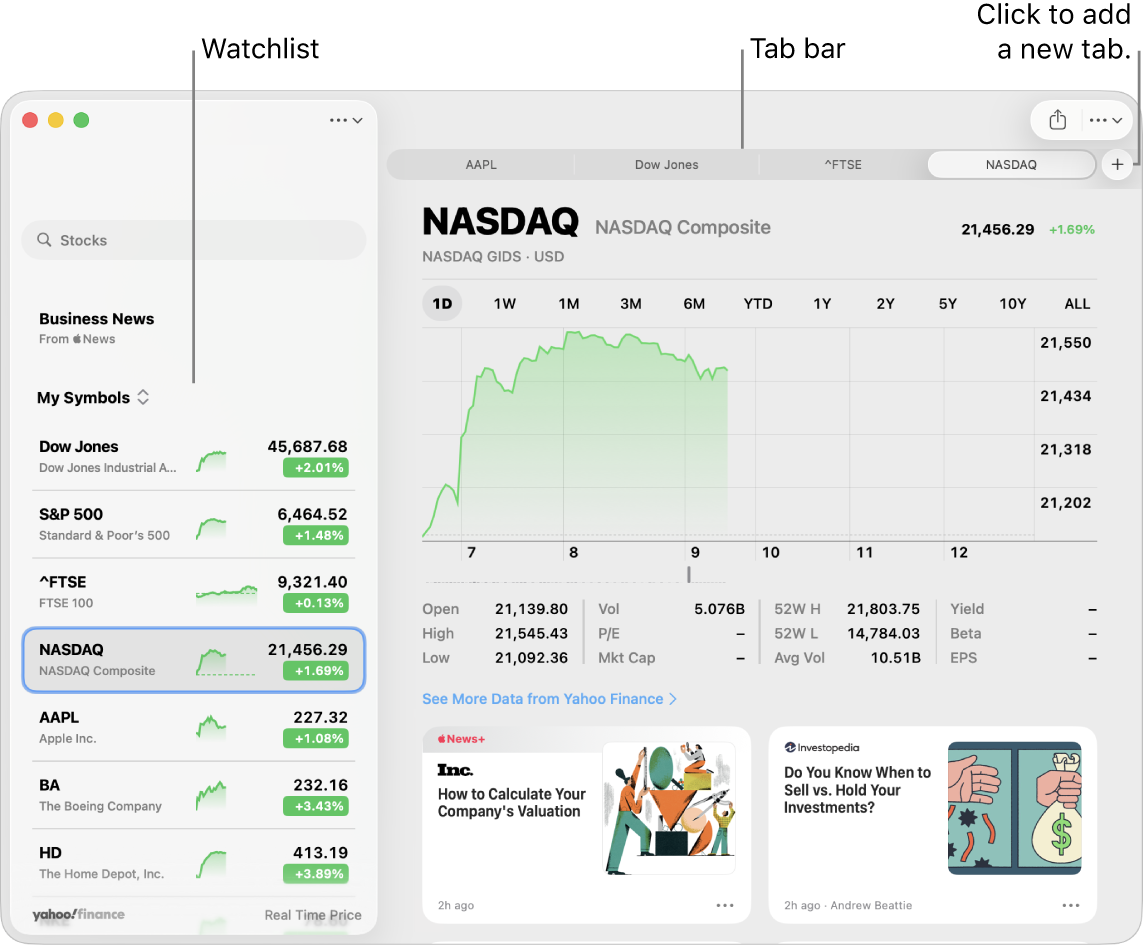

- Dividend Stocks: Investing in dividend-yielding stocks can provide a steady stream of income over time.

- Peer-to-Peer Lending: Online platforms allow small investors to lend money to individuals or small businesses in return for interest income.

- Real Estate Crowdfunding: This allows small investors to invest in real estate properties collectively with other investors, earning rental income or profits from property sales.

- Affiliate Marketing: Small investors can earn a commission by promoting other people’s or companies’ products on their websites or blogs.

Practical Tips for Small Investors

While passive income provides an attractive opportunity, it’s important to approach it with a strategic mindset. Here are a few practical tips:

- Do Your Research: Thoroughly understand any investment opportunity before diving in.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversify across various income streams to mitigate risk.

- Patiently Grow Your Investments: Passive income is a long-term game. Be patient and let your investments grow over time.

FAQs

What is the easiest way to generate passive income?

The easiest way to generate passive income depends on your skills, interests, and financial situation. However, investing in dividend stocks and peer-to-peer lending are often considered easy entry points.

Can small investors really make significant passive income?

Yes, while the income might start small, over time and with strategic reinvestment, small investors can grow their passive income streams significantly.

Let’s remember that every financial journey is unique, and what works for one may not work for another. However, the beauty of passive income lies in its potential to unlock financial freedom and independence, no matter how small the initial investment. So, go ahead and explore the world of passive income, make informed decisions, and see how this financial strategy can transform your life.

Leave a Reply