In the dynamic world of finance, market analysis prediction remains a crucial skill for anyone wishing to make the most of their investments. This article guides beginners through the basics of market analysis prediction, offering insights into methods and strategies to leverage for sound decision-making.

Understanding Market Analysis Prediction

Market analysis prediction involves forecasting the future price movements of financial instruments based on historical data, current economic trends, and broader market events. It’s a blend of art and science that requires both quantitative skills and qualitative understanding of market dynamics.

The Importance of Market Analysis Prediction

For beginners, understanding the importance of market analysis prediction is the first step. Accurate market predictions can help traders and investors make informed decisions, minimize risks, and maximize returns. It is a tool for identifying investment opportunities and navigating the uncertainties of financial markets.

Key Elements in Market Analysis Prediction

Market analysis prediction involves several key elements, such as technical analysis, fundamental analysis, and sentiment analysis.

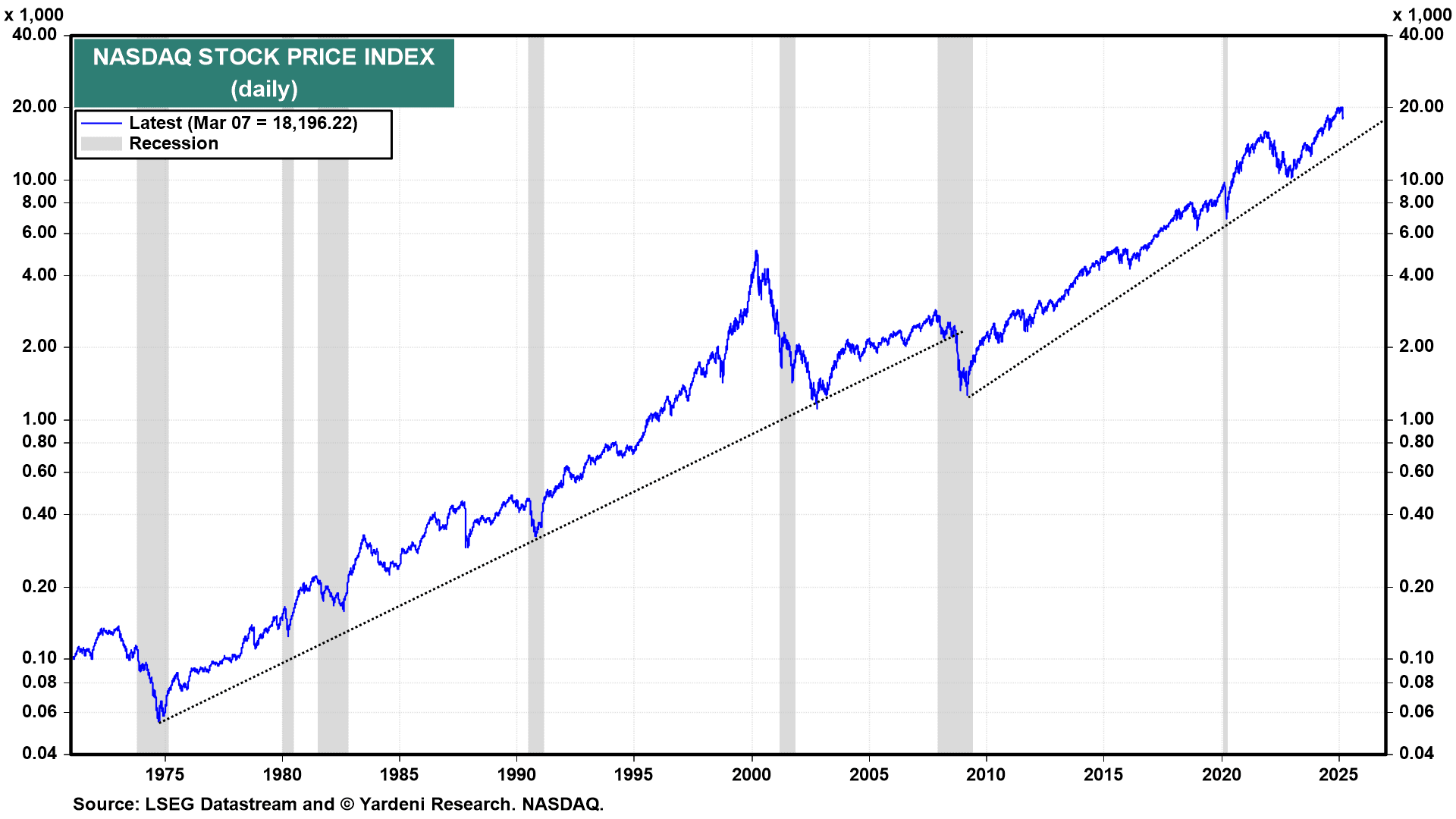

- Technical Analysis: This involves studying price charts and statistical trends to predict future price movements.

- Fundamental Analysis: Here, the focus is on economic factors, such as interest rates, inflation, and corporate earnings.

- Sentiment Analysis: This involves assessing the mood or sentiment of the market participants.

Practical Tips for Market Analysis Prediction

Start with a comprehensive understanding of the market and financial instruments you’re interested in. Stay updated with global and local news, as it can significantly influence market trends. Use a combination of technical, fundamental, and sentiment analysis to make predictions. Practice makes perfect, so start with small investments and learn from your successes and failures.

FAQs on Market Analysis Prediction

What is the role of market analysis in trading?

Market analysis helps traders and investors understand market dynamics and make informed trading decisions. It involves predicting future price movements, identifying opportunities, and minimizing risk.

What tools can beginners use for market analysis prediction?

Beginners can leverage tools such as fundamental analysis, technical analysis, and sentiment analysis. Charts, indicators, and economic data are also useful tools for market prediction.

Remember, the journey to mastering the art of market analysis prediction is a marathon, not a sprint. It requires patience, dedication, and continuous learning. Embrace the journey, remain curious, and never stop learning. With time, you will develop your unique approach to market analysis and become a confident participant in the financial markets.

Leave a Reply